It doesn’t matter what sector or vertical you’re entering, your startup is going to have to deal with competition. Your business idea should be a game changer in some way, but you’re also going to have competition and for this reason you will need to do a competitor analysis early on in the startup journey.

Why focus on what your competitors are doing?

Why? Because knowing your competition is as important as knowing your own business and your customers. A competitor analysis will help you understand where your rival’s strengths and weaknesses lie, sand that will help you to find your own gap in the market. This can help with everything from informing product development, to refining your pitch to investors. It certainly helps in developing the go-to-market strategy, your marketing campaigns and the “voice” of the brand.

You can do a competitive analysis at any point in time, and it will be relevant. You might already have a product that you’re gearing up to take to market. Or you might have little more than an idea on the back of a napkin. Furthermore, a competitor analysis should be an ongoing process. Mature businesses will often renew their competitor analysis to account for changes in the market and the activities of their competitors.

Who are your competitors, anyway?

The first question you should be asking as you set out to complete a competitor analysis is “which companies are my competitors?”

That might sound like a ridiculously rudimentary statement on the surface, and to an extent it is. People do generally assume that a startup founder will have some kind of intuitive understanding of the competitive landscape at the moment that they have the idea. However, in practice it’s actually very easy to make a mistake in both directions; to assume that a company is a competitor when it’s not (this is often the case when a startup entrepreneur looks at a massive global company as a competitor), and to be simply unaware of another startup that is actually their biggest and most challenging rival.

The best way to build your list of competitors is to ask three simple questions:

1) Who (The Customer):

Who are your target customers (and/or companies)? Chances are any other company that has an overlap in target customer segments is a competitor.

2) What (The Problem):

If your product, service or solution solves the same problem as another company, then it’s a sign that you’re competitors.

3) How (Product Category):

How you solve the problem is also an important consideration, and if your technique is comparable to another company, then it’s a sign that you’re competitors.

So, for example, say that you’re looking to start a small security managed services organization. You’re promising 24/7 protection for your client’s IT environment, and the associated consulting services that go with that.

You might be offering security, but Norton, McAfee, and the other security vendors are not your competitors. Those companies offer solutions that individuals and companies install themselves, with their own IT teams, to secure their environments.

Nor are your competitors the big consulting firms like Deloitte or EY. They help organizations with security, but only as consultants. These companies will then go and source and maintain solutions based on their consultant’s guidance.

Your actual competitors will be the national and local managed services providers. What you are providing to your customers is IT skills and the peace of mind of not having to think about their IT environment. Based on that, your closest competitor might not even have a security focus!

How to find your competitors

The most effective competitor analysis process will account for the startups and small businesses that don’t necessarily dominate the media cycle and may not even appear on the front page of a Google search. There are a broader range of research tools that you should use to generate your list for comparison:

Talk to potential customers

Talk to potential customers, and see what names keep coming up when you talk through your own business idea. Make a note of those businesses and dig into why they’re being referenced.

Leverage LinkedIn

LinkedIn has a “Similar Pages” section on every business page. This allows you to see the other company pages that visitors to your page (or competitor’s page) have visited. Chances are that some of those will be related to what your business is doing, and so may be competitors themselves.

Keyword Research

Use tools to help analyze keywords. A Google search is a good first step for drawing a list of competitors, but there’s also the risk of the algorithm giving you a bias—the assumption that the front page of results is the extent of the competition you need to be aware of.

Taking advantage of a free Semrush trial would be an excellent way to get a far deeper understanding of which companies are most relevant to your company’s target keywords, and why.

Be a consumer yourself

Put yourself in the shoes of your target customers, and try and solve the problem yourself. What solution (and companies) do you arrive at after doing your research and narrowing down your options to the (current) best picks?

At the end of this, you want to have a “top 10” list (at most), and that should be a blend of direct and indirect competitors. To use our above example of a security managed services company: a direct competitor would be the other security managed services providers in your local city, who will be pitching to the exact same customers you are.

Indirect companies would be managed services providers that are interstate and not directly pitching for the business (though the customers might find them anyway), or managed services providers that specialize in other fields but may offer to take on security as a “value-add” for their customers.

How to conduct a competitive analysis

Now we get to the fun part. After narrowing down the list of competitors and understanding the motivations behind doing the analysis, it’s time to actually make the comparison!

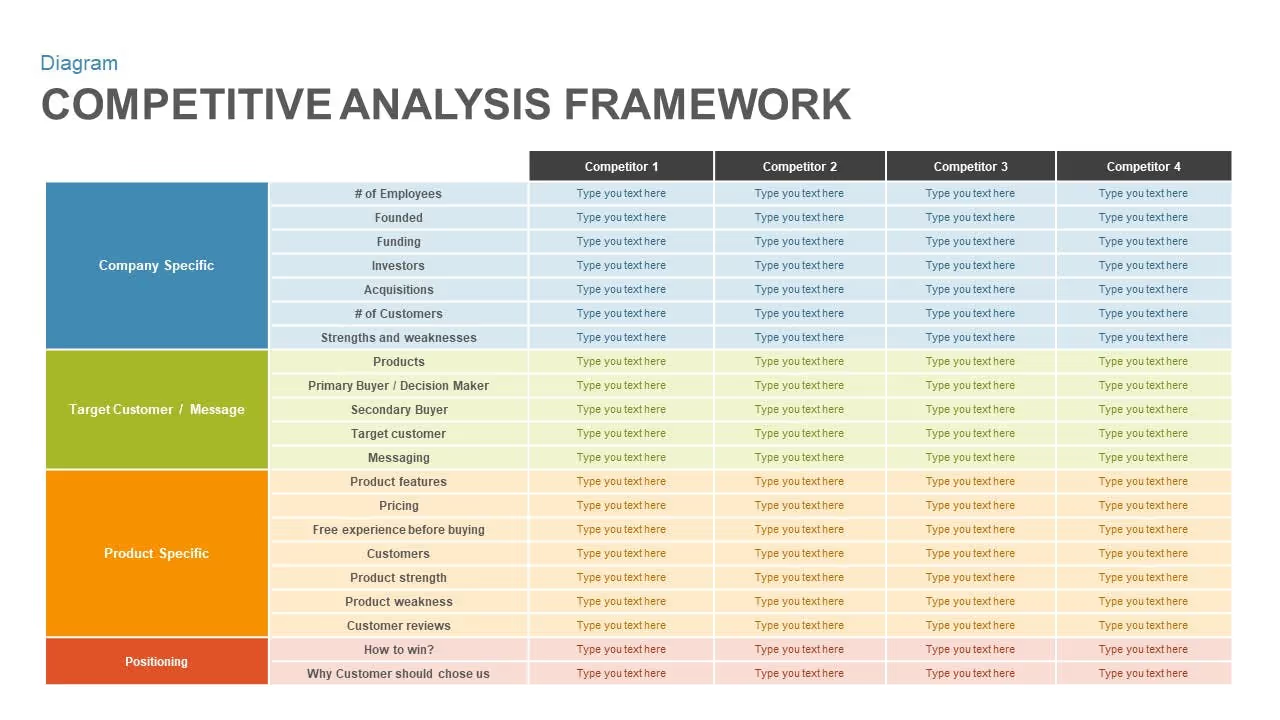

The first step is to draw up a competitor matrix. This is a simple Excel or Google Sheets table that you’ll use to input all of your research and organise it by category. When it’s done, you’ll have an at-a-glance view of your entire competitive environment, and that will help you make direct comparisons between rivals (to figure out which are in the stronger position), and identify trends across the competitive landscape that you might have missed otherwise.

Here's an example of what a competitor matrix might look like:

Download this template for free here.

The actual row fields can vary, according to what’s relevant to your business and sector, and where you’re looking to achieve competitive differentiation, however, we would recommend you ensure that all these fields are covered by the competitor matrix at a minimum:

Business overview

- Founding date

- Company size

- Revenue & customers

It is worth understanding the maturity of the businesses that you’re going to be competing against. As a general rule, the lengthier the incumbency, the more difficult it is going to be to win customers, even if there’s mild dissatisfaction with what’s currently on offer, so this information is relevant to the competitive analysis.

GTM/Customer Acquisition

- Customer awareness

- Customer sentiment

- Acquisition channels

In this section you’ll track how well developed the market is (just how aware are customers of what is on offer), their mood towards the current offering, and how those customers are engaged and acquired.

Product Offering

- Pricing (ASP)

- Features

- Sales model

Understanding where your product/service’s pricing sits is without a doubt critical in determining your go-to-market, but just as important is understanding how the features compare (since customers usually are willing to pay a premium for excellent features), and how your competitors approach the sales process.

SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Finally, it’s always important to run a full SWOT analysis on each company, as you would your own, to learn where you might be able to differentiate, disrupt, and undermine the value proposition of the competitors.

Where can you get this information from?

This is the sticking point; it almost goes without saying that companies will be less than forthcoming with the kind of information that you need to run a competitive analysis at times. However, there are research hacks and tricks that you can use to, at least, arrive at a reasonable ballpark figure.

So, for example, a publicly listed company might be required to share revenue data with the market, but a private company does not. Nor do they need to list the number of employees. These are things that can be approximately calculated, however. LinkedIn will list the employee count range, and a common calculation for revenue is to multiply the number of employees by $150K (if well-funded) or $200K (if moderately funded) to guestimate at revenues. A well-funded company with 52 employees could therefore be calculated at $7.8M in revenue.

You can always determine how well funded an organization is by checking in with the various Angel and VC funds. Crunchbase is the big name for researching this, but there are rivals, like Dealroom.co, that are also worth keeping an eye on. To help get a sense for what to expect and/or chase for your own startup idea, the chances are that your rivals will have their capital raising rounds listed somewhere.

When it comes to the “softer” information, such as customer sentiment and the SWOT analysis, the company reviews can be enlightening. Apps and product listings on stores always have customer reviews, and they’ll be scathing and explicit if there’s something they don’t like. Meanwhile, you can get some incredible insights into the internals of an organization via Glassdoor. This website allows employees to leave anonymous reviews, and as such they tend to be very open and honest about the strengths and weaknesses of the company.

How to leverage your competitor analysis findings

Make sure you make your competitor matrix look nice and is easy to find on your hard drive, because you’re going to be referring back to it a lot in the months ahead!

Use it to make decisions about the business internally

The competitor’s analysis can help guide recruitment (by making it clear what skills should be in your workforce), product pricing, marketing channels and approach and, once you hit a certain scale, potential acquisition targets. Those Glassdoor reviews can also tell you which competitors might have staff you can lure away, and how to build a business that people in the industry want to work at. Meanwhile, the consolidated customer review sentiment can tell you how to establish a great reputation within your sector.

Add it to the pitch deck

Prospective investors are going to want to see that you’ve considered the competitive environment for your startup, so the competitor’s matrix is a particularly useful slide for your pitch deck presentation. What’s more, the information there can help your prospective investors understand what your company’s potential is (as they’ll see the numbers and growth of your competitors), and that can help you to maximize the level of investment in those early stages of funding.

Be more efficient with which investors to approach

Investors don’t tend to hedge by investing in directly competitive organizations. So, if your research brings up the names of investors in your competitors, then you can narrow the list of investors you approach by excluding them.

Stay ahead of the competition

The competitor’s analysis should be a “living document,” that you’re in the habit of updating as new competitors arrive on the market, and your existing competitors make moves to scale, pivot, or release new products onto the market. By keeping track of this, you’ll see opportunities emerge, making it one of the more useful ways to identify opportunities for innovation and disruption.

Final Words

No matter how saturated a market might seem, by the time you’ve finished a competitive analysis you’ll realize that there are almost certainly blind spots among the incumbents. This is what you can leverage to create your own niche within the market. Alternatively, in the wild west of new product categories, a competitive analysis is essential in making sure that you’re taking a differentiated and leadership position over your rivals.

Most great entrepreneurs understand the value and importance of a competitive analysis, and will make it a priority when exploring a new business idea. Understanding your competition early on will help you sharpen your strategy as you develop your competitive moat later. Ultimately, the long-term health of your business depends on it having that competitive differentiation, and that comes from first properly defining what the competition is.