Startup Genome ranked Barcelona 5th, Madrid 8th, and Lisbon 17th in its 2021 Emerging Ecosystem Rankings with measures across performance, funding, market research, talent, and experience. In the first quarter of 2022, Iberian startups raised €1.5 billion in approximately 180 rounds.

Nevertheless, founder and fund growth are not directly correlated, with many talented people seeking growth abroad and foreign capital dominating early-stage investment in Iberia. In this article, we dive into the region’s prominent unicorns and the founders behind them to better understand the origins of success and what’s to come.

Iberian startups and founders

In the past year, nine Iberian-led companies have achieved unicorn status: Wallbox, Remote, Devo, SWORD Health, Jobandtalent, Anchorage Digital, TravelPerk, Fever, and Domestika. Why is that important? Investing early in a unicorn is undoubtedly the goal of most venture capital (VC) funds. With multiple unicorns born in a short period, investors work to understand drivers so they can replicate that level of investment success. Of course, how to predict the next unicorn is a billion-dollar question (no pun intended). Still, a few companies—which we will call soonicorns (recently founded and valued at over $100 million with a high potential of becoming unicorns)—have already shown a good track record.

Defining and measuring the factors contributing to a startup's success is challenging; unicorn status can be a function of its founders, location, timing, economy, luck, or a combination of the above. Nonetheless, using past successes and failures as our data set, we can extract trends from successful companies to predict where to pay more attention.

The number of Iberian startups is snowballing. In 2020, Portugal had 2,159 active startups, 13% above the European average per capita, while the number in Spain doubled to 7,150. According to one study, Iberia presents lucrative opportunities for early-stage investors because of its higher-than-average exit potential, as 0.9% of all analyzed Iberian firms had an exit of over $1 million, 0.2% higher than the European average.

Although $1 million is low, these stats are filled with founder experience. This is material as—according to a Harvard study—repeat founders are more likely to succeed. Sixteen Iberian unicorn founders started at least one company before, with an average of 1.6 prior companies per founder. A population with a high level of founder experience is ripe for success.

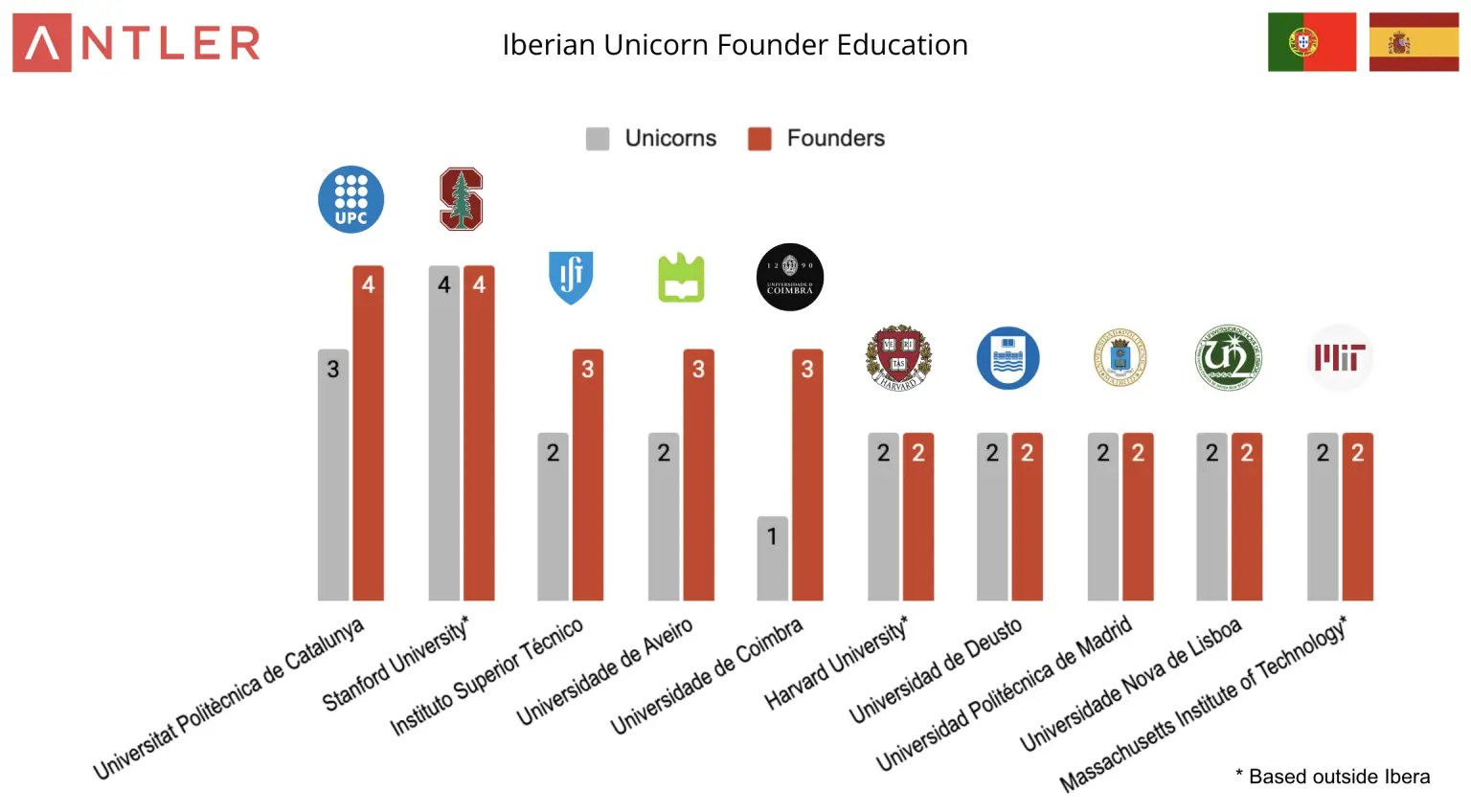

Portugal and Spain also have highly educated populations, offering talent at the top of the founder funnel and staffing to young companies. For example, 72% of local unicorn founders hold a master’s degree. Additionally, all 12 Portuguese unicorn founders have a technical background, which may explain why over half of the Portuguese unicorns identify as primarily software-driven business models.

Of the unicorn founders that pursued further education, several did so abroad. Nine Spanish unicorn founders studied outside Spain, with four Stanford University graduates, two from Harvard University, and another two from MIT. Iker Marcaide is one example—after graduating with a Master of Science from Universitat Politècnica de València in 2005, Iker joined BCG London as a consultant. In 2008, he enrolled in MIT Sloan’s MBA Program, when he founded Flywire, formerly known as peerTransfer.

On the flip side, though 83% of Portuguese unicorn founders completed their last degree in Portugal, 86% of all Portuguese unicorns have headquarters outside Portugal, highlighting a lack of opportunity for talented individuals within the country. As Andrea Barber Lazcano, CEO and Co-Founder of RatedPower, explained, “The main challenge is the lack of references about next steps to be taken, what success and failure looks like, how to approach certain situations, etc.”

For many aspiring founders, the high costs and low revenues associated with the early stages of a startup can be demotivating. The lack of capital for research, experimentation, and development hampers growth.

It's still tougher to compete internationally as a Spanish startup because access to capital and talent is still tougher than it is for startups founded in, for example, London or San Francisco.

— OSCAR PIERRE, CEO & CO-FOUNDER OF GLOVO

Funding and mentorship in Iberia

Private funding in Iberia is increasing. For example, since 2016, Spain has had 199 new funds, more than tripling its number of funds, with the combined value of the Spanish startup ecosystem reaching €46 billion, up from €10 billion in 2015. Furthermore, a view from the Portuguese Association of Business Angels shows a ~2.4x growth in the invested amount from 2018 to 2019.

However, Spain and Portugal still trail the leading European countries in early-stage VC funding per capita, as most investments occur in later stages. Furthermore, Iberian-based funds have investment strategies with a geographic remit outside the region leading to the scattering of the limited available capital. One example is All Iron Ventures in Bilbao, where 65% of the companies in their portfolio are non-Spanish.

Why aren’t Iberian funds investing earlier and with more local ventures when they can capitalize on the first-mover advantage and regional expertise? Because investors seek opportunities with the highest combination of expected return and diversification, which the early-stage Iberian ecosystem may not offer yet. At Antler, we expect that to change due to the ecosystem’s increasing maturity, leading to more deals and funding opportunities.

Despite some hurdles for growing startups in the region, the Iberian peninsula expects growth. Portugal is ideal for e-commerce, energy, environment, food tech, and retail startups. Its small, fast-paced, and steadily growing companies represent over 1% of the country’s GDP. Spain is a leading renewable energy market with vast industrial know-how and potential in both eolic and solar sectors.

“Decarbonization and clean energy transition goals are opening opportunities to make the most of the leading Spanish position in the renewable energy industry,” said Andrea Barber Lazcano.

Because the Iberian startup ecosystem is still in its formative years and more mature European markets have become increasingly competitive in VC deals, international VCs are looking into Iberia as a source of deal flow. “Valuations are still below those in countries such as Germany or France, which is a significant factor,” explained Ander Michelena, Founding partner at All Iron Ventures.

The string of inspirational success stories in a conventionally challenging startup environment will likely inspire talented individuals across the two countries to pursue their ventures, broadening the top of the startup funnel. In addition, capital and mentorship will support early-stage founders, bridging the pre-seed-to-growth stages and filling in the remaining gaps in the startup journey.

In 2017, Xavier Niel, the Paris-born tech billionaire, funnelled €250 million into building Station F, the world's largest startup incubator, to make Paris “the most vibrant tech scene of Europe.” Fast forward to 2022, when France counted five new unicorns in the first 18 days of the year. Like Xavier, many Iberian founders invest in the ecosystem through mentorship and funding, creating a solid feedback cycle. Not long ago, Iker moved back to Valencia, where he started Zubi Labs, a venture builder aiming to provide solutions to social and environmental challenges. Besides breeding entrepreneurship, they aim to connect regional talent with the global economy and accelerate the relationship between investors and startups.

Governance is changing too. Portugal and Spain attract talent with programs like the Golden Visa, extended nomadic stays, and expatriate tax exemptions. In July 2018, the Portuguese Government launched the Startup Portugal+ Programme, including StartUp vouchers, entrepreneur training, and innovation centres. Also, Portugal does not tax the gains from acquiring and selling cryptocurrencies. Similarly, Spain introduced a series of tax incentives, favorable regulations, and flexibility in many procedures through its New Startup Law.

What's next?

The Iberian startup ecosystem is on the rise. The public and private sectors have cultivated entrepreneurship over the past decade, and recent exits speak to the growth and impact of the ecosystem. As investors inject more capital into the early stages, the startup path will offer more opportunities and support for aspiring and visionary founders. As a result, students and professionals will have a stronger incentive to go against the grain and pursue their entrepreneurial passions.

Barcelona, Madrid, and Lisbon are undoubtedly brimming with talent and capital, as seen by the concentration of capital and fast-growing companies. During the COVID pandemic, many tech workers, entrepreneurs, and investors migrated to these Iberian cities due to better living quality in Portugal and Spain, lower costs in Portugal and Spain, and startup-friendly taxes. As these cities continue to establish themselves as startup hubs, the interaction between the local ecosystem and the newly arrived has the potential to breed a new generation of companies built on the expertise of local and foreign talent. Creating a more inclusive ecosystem where people from different backgrounds, communities, and geographies gather and find new solutions to old problems can transform the Iberian economy.

At Antler, we see this once-in-a-decade opportunity to move the Iberian tech ecosystem to the next level of maturity. We are committed to bringing our expertise to support founders in building Iberian-based global success stories (update: here are the stats of our first cohort).

CB Insights, Dealroom, LinkedIn, Pitchbook, Preqin, and other websites have been used to source the data presented in this article. Please contact Nikhil Punwaney, Ricardo Batista or Sergio Massano with any questions, comments, or additions to the data obtained.

.jpg)