In the first week of March 2022, we announced our $29 million Series A funding, along with market entry into India, Indonesia, and the Philippines. That's not to say we don't already have a Global impact. Volopay's client list includes companies worldwide, with their headquarters and subsidiaries in Singapore and Australia. Now, it's time for us to expand to more bases that encapsulate more opportunities.

This new round of funding is going to up our technology game, with the money being put into Global hiring, product development, and expansion across the APAC region. Our next intended audience, MENA countries, are on the horizon, as well.

Bear in mind that Rajith and I had this growth plan in mind from the minute we joined Antler's accelerator program. "It was one of the best moments of my life, and if it weren't for Antler, we would have most likely given up on our dream" Rajith recollects. The program was our ticket to giving our entrepreneurial idea a voice and a platform to succeed. After all, one of Antler's guiding principles is to be "uncomfortably ambitious" — and it is this mindset that has caused Volopay to successfully disrupt the FinTech scene in the APAC region.

The network that Volopay built with the guidance of Antler has been instrumental in our success — especially since it was followed by acceptance into Y-Combinator and Nium's Bolt FinTech accelerator program. Even today, a couple of years later, the Antler network aids Volopay in reaching our intended audiences and finding like-minded geniuses to invest in our game plan.

So, what does this Antler-backed startup bring to the financial table?

"Every company knows their revenue in real-time. But they all struggle to do the same with costs. Only at the end of the month does each department submits its expenses. Until then, the CFO has no idea of the real-time spending of the company" says Rajith. In a few sentences, he has described a major problem that most companies face, from startups to large corporates. This is where Volopay steps in.

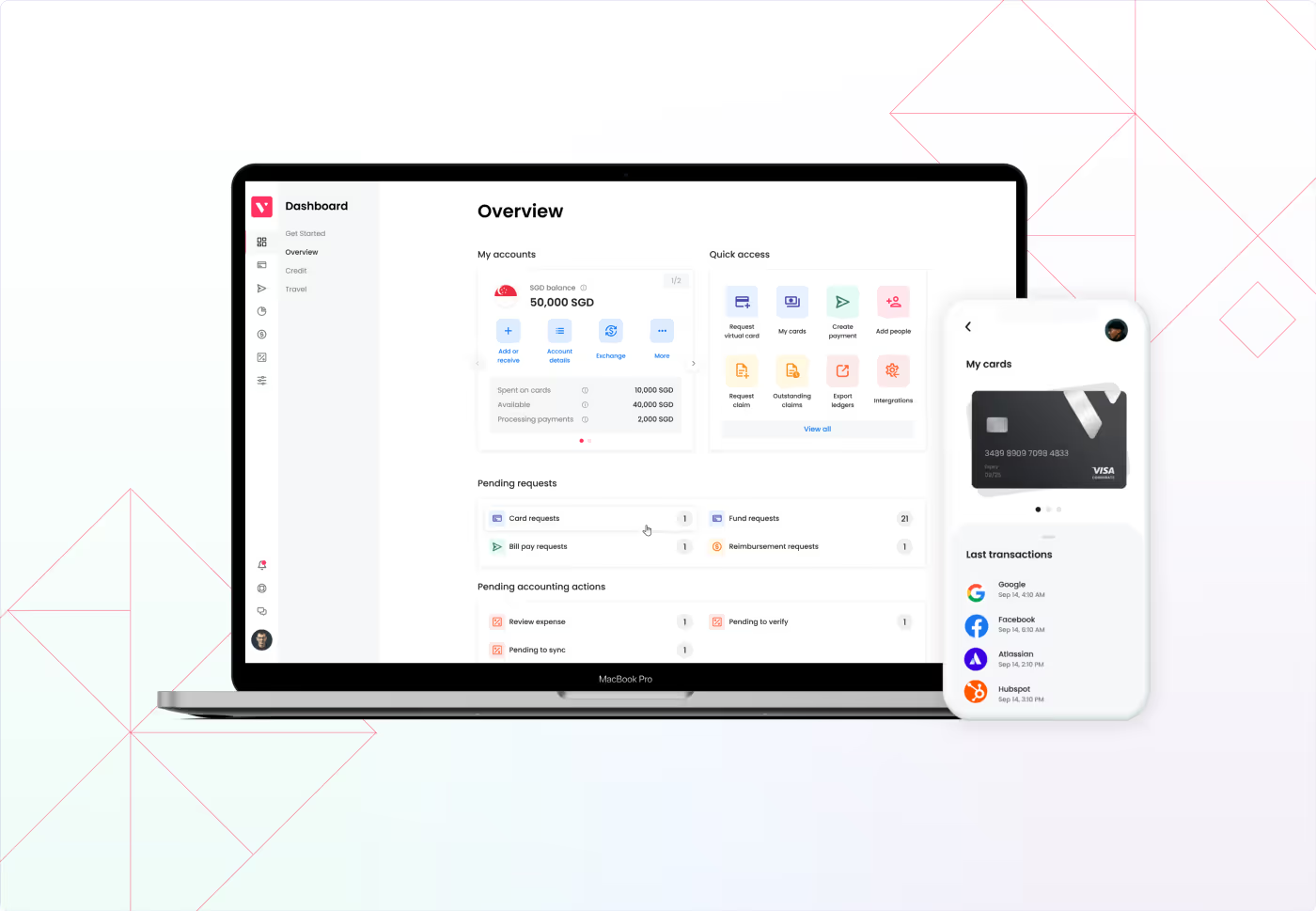

An all-rounded suite of expense management products, Volopay intends to automate a variety of manual tasks that finance departments struggle with. An easy-to-understand dashboard is what greets every user — and we don't just mean the manager. Volopay allows a company to add every single employee to the system so that everyone has visibility into key financial processes.

This dashboard features a Bill Pay system that the company can use for their accounts payable, and for an overview of the credit line that Volopay also offers. Boasting integrations with leading accounting software (Xero, Netsuite, Quickbooks, to name a few), Volopay records all business transactions in real-time and also generates reports that can be exported to these accounting systems.

One of the more impressive features of Bill Pay is the ability to hold multiple-currency accounts. As Rajith has pointed out, international remittance and FX fees can put a big dent in the wallet of businesses. Volopay tries to eliminate these extra costs by offering competitive SWIFT and Local transfer rates.

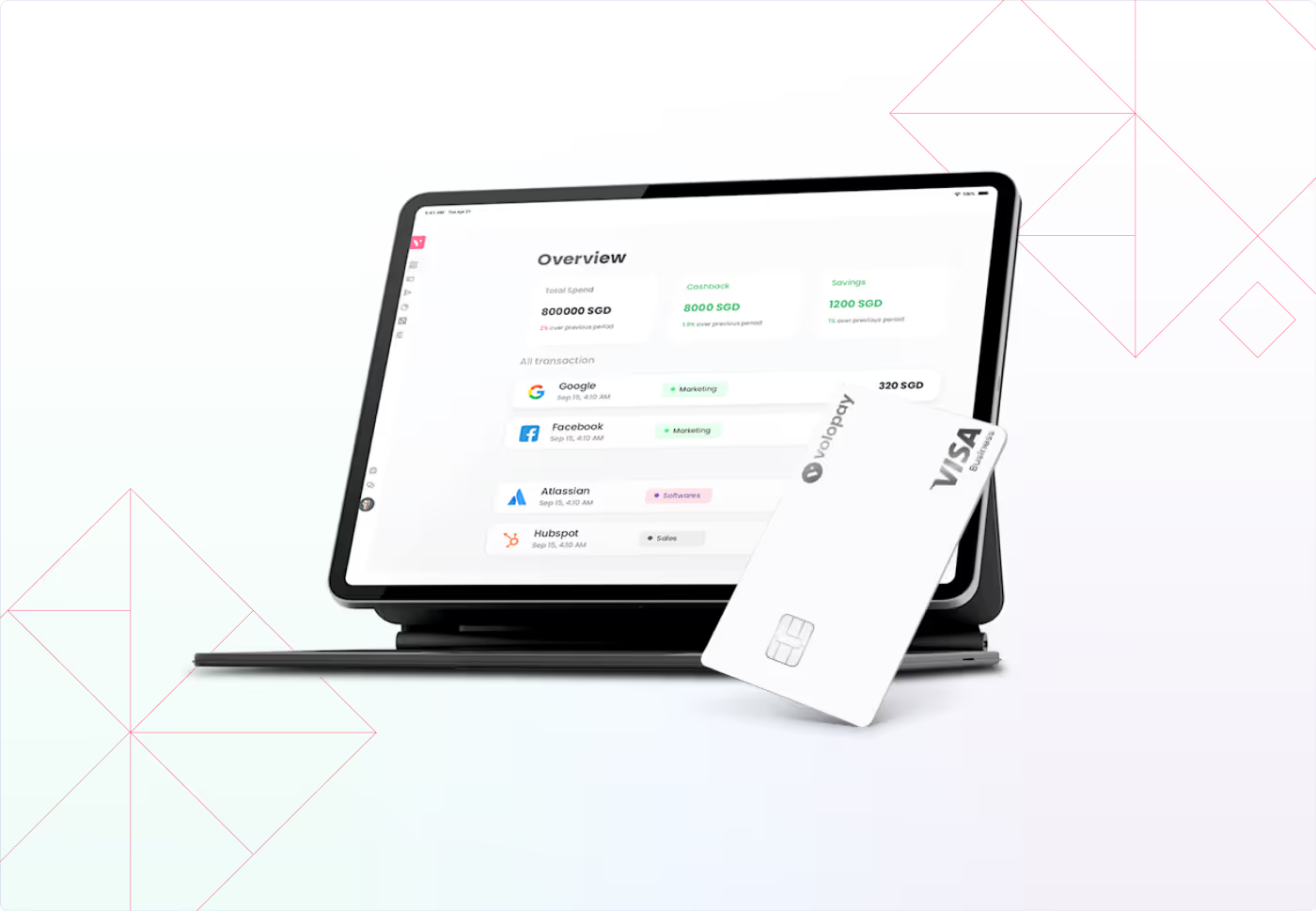

Undoubtedly though, with our new market entries, our most beloved offering is our corporate card. Interestingly, it was corporate cards that sparked the idea of Volopay, to begin with.

"I traveled a lot for business, and I had to sit and file all my business expenses manually at the end of the month" Rajith tells. "It used to take me a couple of weeks as I did not have a corporate business card, which was very frustrating. I investigated the problem deeper and realized it was complicated to issue corporate cards."

He is not wrong. Rajith, I (his colleague back then), and millions across the globe play the hectic juggling game of reimbursement claims. Volopay intends to get rid of reimbursements altogether. Granted, we do have a real-time reimbursement claims platform. Any employee can request reimbursement by attaching receipts as soon as an expense is made. Like all other expense trails, these come with delegated multi-level approvers so that employees aren't waiting to get reimbursed for a long time.

However, Volopay is encouraging companies to switch to the safer and more transparent method of corporate cards. Providing an option of both physical and virtual VISA cards, Volopay also allows companies to apply for a credit line to be included with these. Companies are then able to assign cards with spend limits to multiple employees. They can even assign cards to multiple vendors for dedicated transaction reports, or specific departments for budgeting purposes.

Clients clearly love it. In the past two years alone, Volopay has onboarded the likes of CoinDCX, Polygon, Deputy, Funding Societies, Livspace, MX Media, BukuWarung, Upmesh…just to name a few of their 700 clients.

Volopay has allowed Deputy to easily manage the use of virtual cards across the business, integrate seamlessly with Netsuite, and has removed wasted reconciliation time by the Finance team

MICHAEL EVES, SENIOR DIRECTOR OF FINANCE AT DEPUTY (ONE OF VOLOPAY'S CLIENTS)

It was hardly a solo effort. In less than a year, Volopay has grown from a small group of 20 to a company of more than 150 employees, all stationed across the world and dedicated to bringing game-changing financial management solutions.

We are not stopping here.

While some of the funding will be put to use in R&D and the development of software improvements, Volopay is determined to integrate with more aspects of financial independence. Already we have integrated with one HR portal that automates payroll. Next is tackling all aspects of cross-border payments, alongside other ERPs, HRMs, and CRMs. The goal is to eliminate outsourcing and allow businesses to become self-reliant in how they manage their money.

Volopay is certainly not alone in its journey. Our vision is supported by JAM Fund, Winklevoss Capital Management, Rapyd Ventures, Accial Capital, FinTech veteran and angel investor Jeffrey Cruttenden — Founder of Acorns along with Access Ventures Capital, Antler Global, and VentureSouq (and that's just the Series A round of funding). Our other supporters include extremely successful businesses like WeWork, Facebook, and Tinder.

The vision in question? Simple:

Empower the next generation of businesses around the world with the best tools to achieve their full growth potential. The aim is to fully disrupt the way traditional business banking works. Volopay, instead, aims to become the singular solution to growing Global businesses.

It's an ambitious project, for sure. Our team knows it too. We've built our own infrastructure in order to serve all the unique needs of different businesses in different economies.

To achieve this, Volopay has embarked on the ambitious objective of applying for financial licenses in its markets.

"Many of our competitors around the world will opt to integrate with 3rd-party infrastructure suppliers to provide financial services. This limits the type of products you can offer clients, and with each region playing host to its own network providers, it is almost impossible to deliver a consistent and delightful customer experience for our Global company clients operating in different parts of the world" said Rajith. "We are doing something no other company has done regionally, we are building our own infrastructure. Not being held back by the limitations of an intermediary, this foundation will not only let us create highly innovative financial products, but also a pleasant and reliable customer experience across all our markets."

The encouragement of financial independence is to focus on scalability, productivity, and overall business growth for all their clients. We're dedicated to making it happen, despite the very clear hurdles that every country's economy poses us. Gaining financial licenses is, after all, an obstacle course — one that Volopay is happy to maneuver through.

In Asia-Pacific markets, we have to work with banks and other stakeholders. So it's a very bold challenge for us as we expand our platform across the region. But if we can do it here, then we can easily achieve our vision to become a Global leader in spend management software.

Rajith and I are both clear on this — that we are willing to work hard to make the product available Globally. Already, our offerings of cashback and multi-currency cards (particularly USD cards, required by any department using popular SaaS subscriptions) have attracted attention even in countries we are yet to touch.

From the way our success is blooming, it will only be a matter of time before we reach those companies, too. In the meantime, we are celebrating this new milestone by bringing product updates and impeccable customer service to those we can help

–

About Volopay

Volopay is a Singapore-based company on a mission to build a financial control centre for modern businesses. Volopay combines business accounts, corporate cards, bill payments, expense reimbursements, credit, cashback, and accounting automation into one single platform. Since launching in Singapore and Australia the startup has been on a strong growth trajectory and is now stepping into India, Indonesia, and the Philippines with MENA expansion on the horizon.

–