In January 2023, 95 people joined Antler Australia ready to launch their own startups. This is one of the biggest cohorts we’ve ever had.

These people joined knowing that it's a requirement to participate full-time, meaning they don't have a job to fall back on. In most cases, they join without a co-founder or team, and sometimes even without an idea as to what they will build.

And not only that, they did so despite concerns about a looming global recession sparked by war in Ukraine, a global energy crisis, soaring inflation and cost of living.

So, why do this in the face of such potential risk?

Historically, businesses born from uncertainty thrive

Many household brands we know and love today were born during the last global recession - think Uber, Airbnb and Square. These companies were founded and funded between 2008 and 2009, the peak of the global financial crisis.

Born from necessity, their success can be attributed to their adaptability and speed to move with shifts in consumer behaviour and answer service demand when incumbents couldn’t react as quickly. This environment in turn bred a more resourceful and resilient founder type who in improved operating conditions outside of the recession went on to flourish.

Similarly, the global Covid-19 pandemic saw unprecedented disruptions in supply, demand, and productivity, which had monumental health, social, and economic implications across the world.

But the question remains: Has history repeated itself, and are unicorns set to emerge off the back of this crisis?

Antler has data that can shed light on what might be to come.

Let’s take a look at Antler’s Australian portfolio companies born in 2019

For those unfamiliar with the Antler model, we work with ambitious individuals looking to launch their own businesses. To do this, we introduce them to a cohort of like-minded and skilled peers also ready to build their own startups. And with a little help from our team of startup and VC experts, these people can have a high-potential, validated and funded business up and running in a matter of weeks.

In Australia, the Antler cohort most affected by the Covid-19 downturn was that which launched in mid-2019.

Despite that, that intake remains the largest-ever cohort with 99 founders signing up to participate. And from that group, 15 businesses went on to gain Pre-Seed investment from Antler.

Are these companies - launched in the midst of crisis - showing early signals that we are set for a repeat of the early 2008/ 2009 breakout successes?

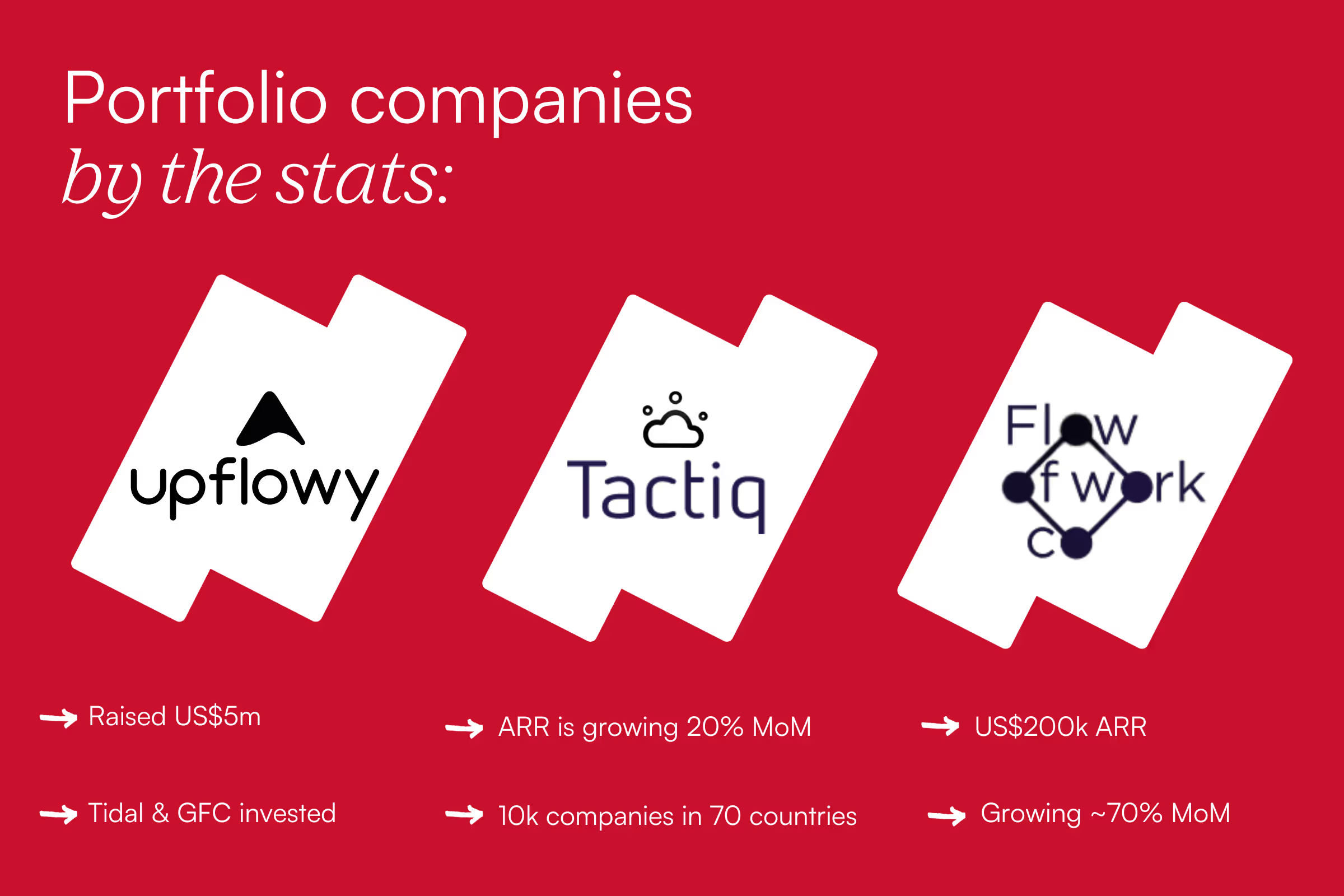

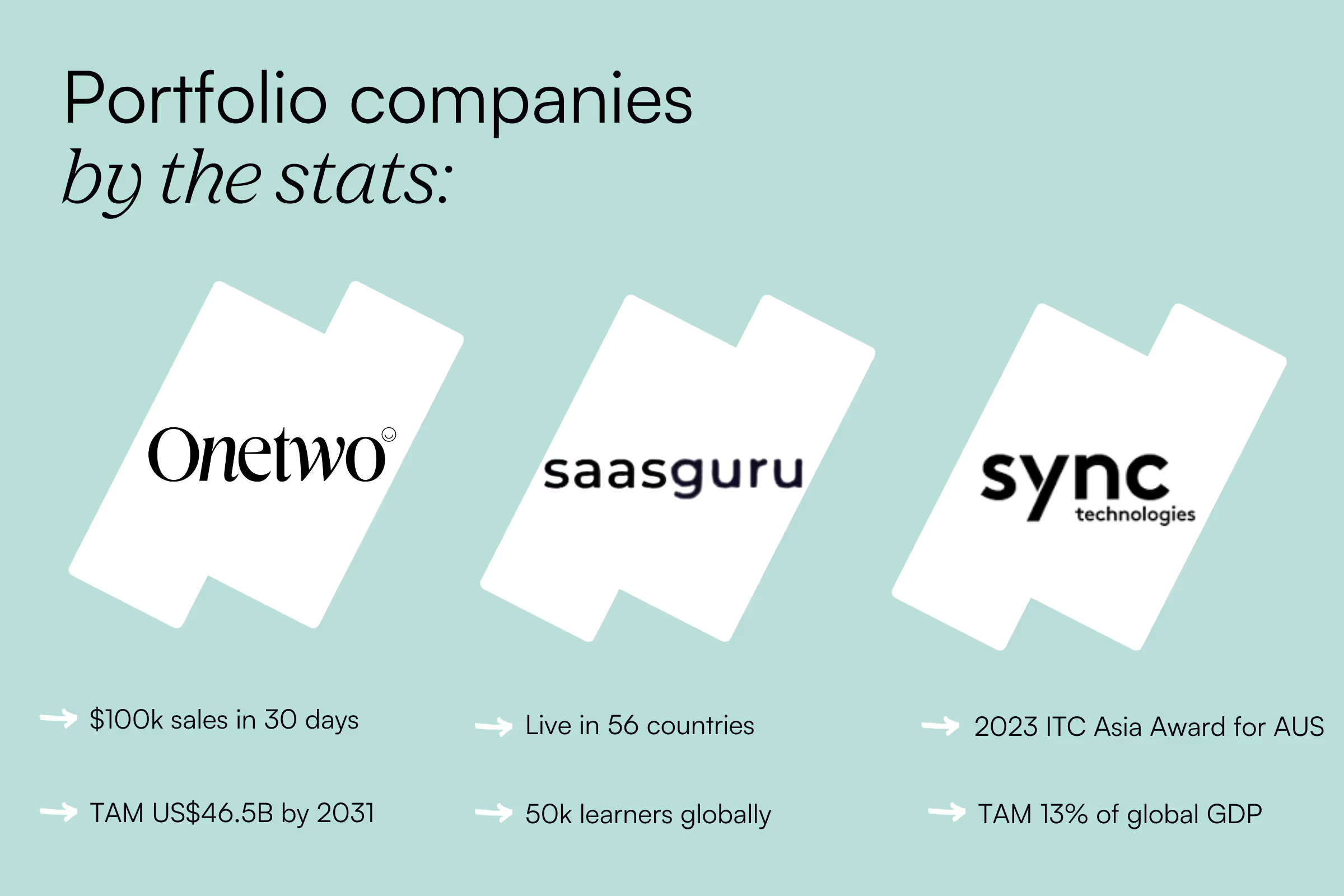

After just two years of operating, these six companies are showing an 8x multiple on Antler’s initial investment securing additional capital from top local VC SquarePeg and institutional American investors.

Carolina Dreifuss, co-founder of SyncTechnologies (SyncTech), an Antler portfolio company that launched in 2019 says, “Founders building in downturns usually often face restricted funds, fewer resources and a rapidly changing environment which is why they need to work smarter. To reach your goals, founders must think creatively and explore smart ways to get from A to B in the fastest possible way, with the lowest cost and the highest return.

“In the early days of SyncTech, the environment was constantly changing and we had to adapt and use it to our advantage. We worked with ‘small experiments’ to learn fast and we made adjustments on the go.”

SyncTech capitalised on changing environments. It created a digital twin of construction sites meaning employees did not have to be sent to in-person inspections as Sync could bring the digital version to wherever needed. As such, in periods of lockdown, it enables work to efficiently continue and remains valuable with free movement as it provides a huge cost saving to companies, in particular, insurers who often need to send multiple people to gather the needed on-site assessments.

Born from difficult times, these startups just a couple of years on are thriving and attracting significant capital.

Tough economic conditions can have a number of adverse impacts on many industries, and as a consequence often result in hardships for individuals and their families. So, by no means, do we wish to minimise that experience, however, we do hope to highlight that despite difficult situations opportunities to innovate are present and can be highly rewarding.

Tech layoffs

Let’s take the recent wave of tech layoffs as an example.

As we know, redundancies are a brutal reality of turbulent market conditions, and over the last few years, many job cuts have been concentrated in the tech sector following massive industry growth, IPOs, and more.

According to US data published on NerdWallet, more workers in tech were laid off in 2022 than in 2020 and 2021 combined.

In the article, the author pens a grim list of the big-name tech giants such as Meta, Amazon, Microsoft, Alphabet, Spotify, Dell, Zoom and Twitter cutting between 600-12,000 employees each in the last six months alone.

Even over the last couple of weeks, this reality has played out locally across established and promising ANZ technology companies.

Grocery delivery service Milkrun announced it will cut 20% of its workforce, Atlassian revealed it is laying off about 5% of its workforce, and Xero will cut 800 jobs which represent about 16% of its global workforce.

What we have seen at Antler, is that hard times often correlate to larger cohort sizes. Many see redundancy as the opportunity to finally launch their own business. Even as I write, individuals are forming teams and validating ideas as they prepare to pitch to the Antler Investment Committee in April.

One of these founders is Stuart Dalrymple.

“My team [and I] were made redundant at the end of 2022,” he says.

“In hindsight, it was the best thing that ever happened, because through the redundancy it gave me some personal runway to explore my long-term dream of founding my own company”.

And it seems this is somewhat of a shared experience with those who aren’t laid off but working for companies making redundancies.

John Velasco, who is also currently participating in the cohort, says as his former employer scaled back operations he felt his career prospects were stifled, and as such saw Antler as an opportunity to keep moving forward.

“My previous company scaled back and growth was deprioritised,” says John.

“Whilst they were doing great things, the period ahead for me meant little progress, so I realised there was no better time to switch to entrepreneurship.

“It has been a long-held dream that, until now, I had been putting off. It's liberating and exciting to have started the journey with Antler.”

And it’s not just Antler that presents an opportunity for those impacted but recent market conditions.

Rise of entrepreneurship

Entrepreneurship more broadly is on the rise on a global scale, undeterred by economic uncertainty.

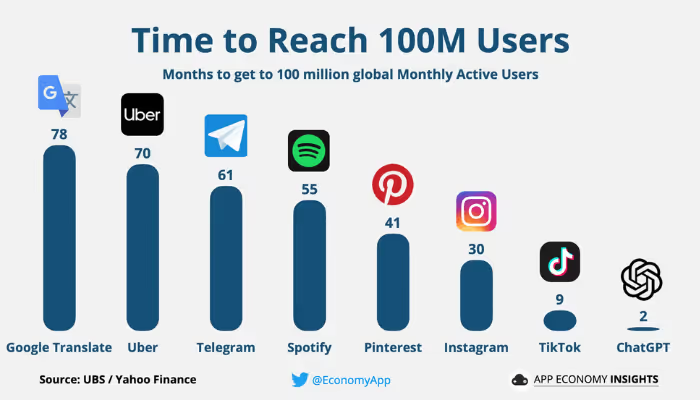

Access to low-cost, high-impact technologies has made it possible to reach vast segments of the population faster than at any time in history.

To highlight the speed that companies can now scale; the airline industry took 50 years to reach 50 million customers, Pokemon Go took 19 days and it is possible that ChatGPT, which launched in November 2022 and has claimed the spot as the fastest-growing app in history, could have reached the same size audience in a matter of hours.

Founders can now start a business from any location and we are seeing top tech companies originating more evenly distributed across the world. As an example of this, the global unicorn club is bigger than it's ever been with over 1,200 private companies. According to CBInsights, this has more than quadrupled from 269 in 2017.

At the same time, the need to create impact has never been more pressing as we as a society begin to align on and reach global carbon emission targets. This alone has catalysed a new generation of companies in emerging categories such as battery storage startup Amber, through to carbon measuring and offset seen in Antler’s portfolio with PathZero and Trace.

And if current studies are right, the rate of entrepreneurialism is only going to increase.

According to a recent Nielsen study published in Forbes, more than half of Gen Z want to start their own company. Their reasons? They want more control, they want to be debt-free, and lead a purposeful, impactful life. Compounding this, a significant portion of this demographic also believes that attending university, and its associated cost, isn’t a requirement for them to achieve their goals.

“About one in five Gen Z and young Millennials say they may choose not to go to college. Many others see a less conventional path through education as a good idea,” the report finds.

Traditionally, careers in finance and law attracted the brightest as they were believed to have the greatest opportunity for wealth creation. However, a nationwide survey published by professional services firm EY and EIG (Economic Innovation Group) had some interesting findings that speak to the rise of entrepreneurship in prestige and attractiveness as a career pathway:

- Millennials overwhelmingly (78%) consider entrepreneurs successful

- 62% of millennials have considered starting their own business

- 55% believe their generation is more entrepreneurial than past ones

Complementing this founder mindset is the sheer amount of resources, grants and community support at the hands of the public to help them on their journey. From community hubs funded by the government such as the Sydney Startup Hub, or full-fledged ecosystems such as LaunchVic and grants such as the NSW MVP Ventures. To co-working spaces such as Tank Stream Labs, dedicated publications such as Startup Daily, meet-ups, conferences and more. If people are looking for ways to launch a business or meet like-minded people, the opportunities are readily accessible and available.

Overall, we live in a time of immense disruption but from this period opportunity will rise. As we have seen, uncertainty leads to innovation, and those looking to harness it can realise potential.

If you would like to build a company with Antler visit our website for further information on our founder offering: www.antler.co. Applications are currently open for our Jan '24 intake, apply here.