Growing up in Australia and Syria, studying in Argentina and South Africa, and working in Congo, Spain, and the Netherlands has given me a unique perspective on the power of diversity. Throughout my career I have worked in international teams in various industries and in different sized companies. To me, it’s evident that diversity should be embraced, that all voices should be heard, that the best ideas should win, and that diverse teams perform better.

When I joined the world of venture capital (VC) in 2020, I was shocked. Time in this industry had stood still. Whilst in other industries I worked in the discussion was about topics like ageism or socio-economic diversity, in VC we are still stuck on the gender and race discussion. On a daily basis, I seethe challenges faced by underrepresented founders in securing funding. How can it be that in the startup world—characterized as innovative and forward-thinking—VCs are struggling so much to accurately address diversity?

Since my early days I’ve learned that a big part of this problem is rooted in unconscious biases. Biases are something that we all have—we can not turn them off. If you have a brain, you're biased. But what we need to do is to actively acknowledge that biases affect our decision-making.

Unconscious bias has been one of the consistent topics of my career. Through training and employer resource groups I’ve worked to better recognize and understand them in myself and in others. Ever since I joined the VC space, I have taken it upon myself to be an advocate on the topic. I sit on Antler’s global D&I council, I regularly host workshops for founders, and lately I’ve been happy to be invited by other VCs to run workshops for their teams and to share insights on how to address their biases. In this article, I am sharing with everyone in VC what I have learned over the past 10+ years.

Everyone wins with diverse teams

It’s well known that venture capital is a high risk, high reward business. Traditionally, VC investors enjoy around 25%-35% returns on their investments. So why should these investors change what they already know is good? Is there any financial incentive for them to change how they invest? Well...YES. Diversifying your investments is not only the right thing to do, but it also makes economic sense. To put it simply, most VC firms today are leaving money on the table.

A study by Forbes has shown that no matter how you slice the data, diverse teams outperform homogeneous teams, and the numbers back this up. Teams that are diverse by gender and ethnicity generate 30% higher MOIC (multiples on invested capital) compared to homogenous teams. Companies with at least one female or one ethnically diverse founder generate over 60%+ in business value (source).

When considering exits in the VC world, the returns from diverse teams are notably higher than those from homogenous ones. Ethnically diverse founders enjoy an average exit multiple that is 30% higher than those of solely white founding teams (3.26x vs. 2.5x). Additionally, studies have shown that venture firms with at least one female general partner generate 9.7% more profitable exits (source).

This is not to say that white founders have a lower propensity for success than others. It demonstrates that a diverse mix of founders and executives is crucial to building a truly great organization. Diversity is about variety: a diverse group contains people from different backgrounds, of different ages and sexes, and/or with a wide variety of interests and opinions.

Why do diverse teams perform better?

But it’s not only about the numbers. Studies have shown that there are many reasons why diverse teams perform better than homogeneous ones.

Diverse teams bring a wider range of experiences, perspectives, and ideas to the table, which can lead to more creative and innovative solutions to problems. They are able to approach challenges from different angles and come up with novel approaches that homogeneous teams may not have considered.

When teams are diverse, they are often better decision-makers. Different perspectives and experiences often help to identify potential biases or blind spots that may have been overlooked otherwise. By considering a variety of viewpoints, diverse teams can arrive at more well-rounded and informed decisions.

Having a diverse team often leads to an increase in creativity. When people with different backgrounds and experiences work together, they can generate new and original ideas that may not have been considered otherwise.

Diverse teams can help companies to better understand and connect with a wider range of customers, and leads to broader market appeal. A team that reflects the diversity of their customer base can bring a deeper understanding of their needs and preferences, which can ultimately lead to better products and services.

When employees feel that their workplace values and respects their differences, employee satisfaction improves and employees are more engaged in their work. This can lead to improved productivity and reduced turnover rates.

Overall, investing in diverse teams is not only the right thing to do, but it is also a smart business decision. Diverse teams can bring a range of benefits that help companies to be more innovative, productive, and successful.

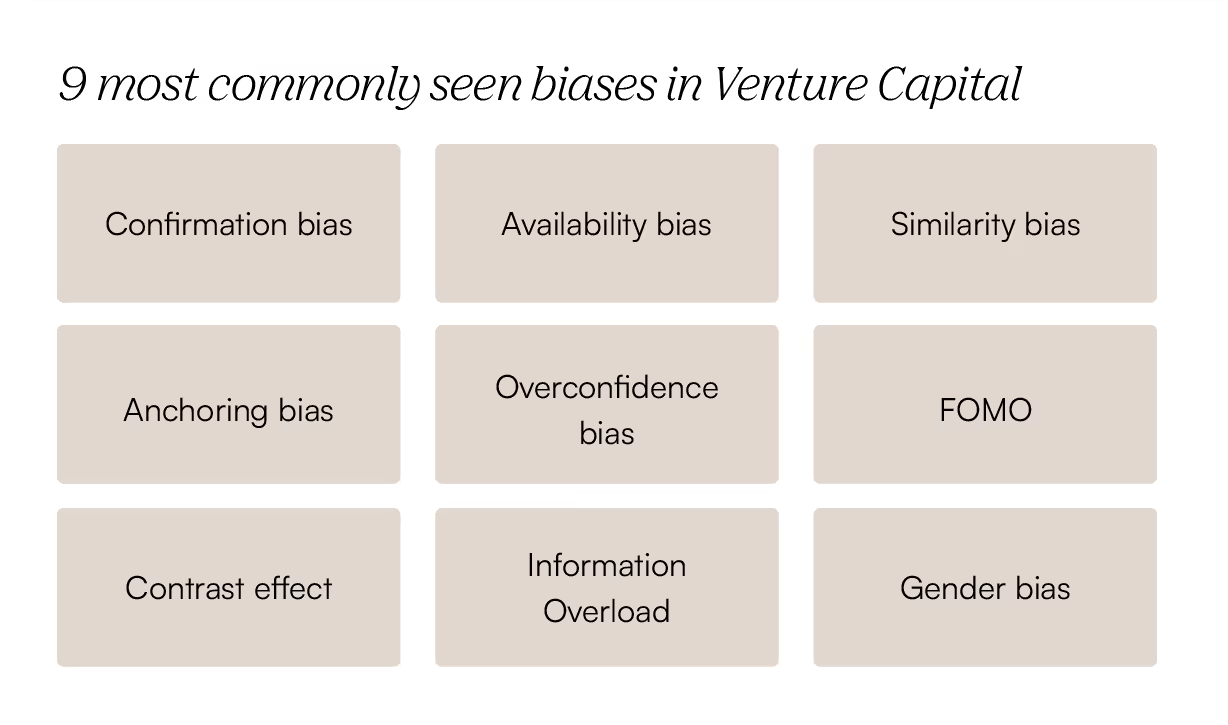

The most common biases in VC

Now that we understand how diverse teams perform better, let’s address some of the most common biases that are derailing the VC world from supporting and funding diverse teams. Here are the nine most common ones based on my own experiences in the industry.

Confirmation bias is the tendency to seek out information that confirms one's pre-existing beliefs and to discount information that contradicts those beliefs. Essentially, it is seeing what you expect to see and hearing what you expect to hear. In the financial sector, investors rely more strongly on and spend more time focusing on information that confirms their preceding knowledge or opinion about a given investment opportunity. An example of the disastrous effects of confirmation bias is evident with the investors of the infamous blood-testing startup Theranos. When prominent investors (like former Secretary of State George Schulz, who was also a close personal friend of the Holmes family) were presented with fact-based evidence that Theranos was a complete scam, they refused to believe it.

Availability bias is the tendency to give greater weight to information that is more readily available, such as recent success stories or high-profile companies. In the context of VC, this can lead investors to overlook less well-known startups or to overestimate the potential of certain industries or trends.

Similarity bias is the tendency to prefer people who are similar to oneself. In the context of VC, this can lead investors to favor founders who have similar backgrounds, educations, or experiences to their own, even if these factors are not directly related to the success of the startup. According to some sources, 89% of the decision makers in VC are white and male (source). No wonder it is harder for women and non-white people to raise funding as the similarity bias is working against them.

Anchoring bias is the tendency to rely too heavily on the first piece of information encountered when making decisions. In the context of VC, this can lead investors to place too much emphasis on initial valuations or projections, rather than considering other factors that may be more important in determining the success of the startup.

Overconfidence bias is the tendency to overestimate one's abilities or the accuracy of one's beliefs. Some VC investors believe that they are somehow gifted and have special intuition and reasoning skills that help them predict the outcome of the market. This could be because they believe that they have some special skills. Alternatively, they might also falsely think that they have access to superior information, which is why their decisions will always be better. In simpler words, overconfidence bias is a belief amongst investors that they are smarter than everyone else. Masayoshi Son might have suffered from this bias when he invested $17 billion (roughly one-fifth of SoftBank’s tech-focused Vision Fund) into WeWork. A scary amount of concentration risk, especially for an unproven business model.

FOMO—or 'fear of missing out'—is intimately familiar to everyone in the VC industry. While it can be a positive tool for pushing ourselves not to miss out on the next market leader, it can also cause us to make rushed or uncharacteristic decisions. It's vital to be able to thoughtfully analyze deals by removing them from surrounding events. For example, right now, everyone wants a piece of the AI market, but FOMO investing in an AI company without spending extended time on an objective assessment of its team, technology, and market opportunity is potentially destructive and certainly unwise.

Contrast effect can sneak up on investors, especially after days of back-to-back founder pitches. It occurs when two objects are judged in comparison, when they should be assessed individually. One example might be sitting through a string of five average company pitches, followed by a simply okay one, which can skew one into an unnecessarily favorable opinion. So, when assessing a startup, think about the context, then ask: "Have we just seen a string of below-average companies that may be coloring how we view this opportunity? If we had seen this first thing in the morning, would our outlook be the same?"

Information overload is the tendency to place too much attention on information when it's barely relevant. Investors typically have to process large amounts of data, for example analyzing technologies, teams, markets, trends, business models, and different types of risks. This massive amount of information provided to investors can result in information overload. Research has found that the more information a VC receives, the greater confidence investors will have in their decisions. Some investors never give an answer and keep asking for additional data points in the hope that the data will make the decision for them (source). Although this finding seems rather logical, the reality is that more information does not necessarily equate to better decision-making. Researchers have found that when investors receive more information, they tend to believe they will make better decisions, when, in actuality, more information simply increases confidence in the decision rather than accuracy. And, as confidence increases with more information, the accuracy of the decision actually decreases.

Gender bias refers to the systematic preference or discrimination against female founders or female-led startups when it comes to funding decisions. There are several causes of gender bias (lack of representation, stereotyping, networking challenges etc) but the following research example highlights partly how this unconscious bias manifests.

A simple study was done across countries and over time and it asks people to list down all the descriptors that come to mind when you think of a typical male, a typical female and a typical manager. Seventy-one percent of the words used to describe a typical overlap with those of a typical manager and only 10% of those words have overlap with words we use to describe a typical female. The qualities we think men have are also the qualities that we think make for good leaders. So unconsciously we think that men make for better leaders (source).

It's important for VC firms to be aware of these biases and to take steps to mitigate their effects. This may involve diversifying the investor pool, seeking out a broader range of startup opportunities, or implementing processes to ensure that decisions are based on a range of factors, rather than just a few key data points.

11 strategies that will help your VC tackle unconscious biases

Unconscious biases can be challenging to address because they are often deeply ingrained and can operate at a subconscious level. However, there are several strategies that VCs can use to help mitigate the impact of unconscious biases in their decision-making processes:

1) Promote awareness: Bias is part of being human, but we can't tackle it if we don't acknowledge this. Simple awareness of bias is usually the first step to reducing it. VC firms can promote awareness of unconscious biases by providing training and education to investors and other stakeholders. This can help to raise awareness of the impact of unconscious biases and provide tools and strategies for mitigating them. Introducing your team to the most common unconscious biases that investors face gives the whole team a shared language around the topic and it makes it easier to recognise them in yourself and in others.

2) Take your time: Unintentional bias is more likely when you make fast decisions or act on the spur of the moment, so be sure to take a step back. When we have to act fast, our brain relies on cognitive shortcuts. Making a snap judgment based on someone’s race or gender takes much less mental work than making a considered decision based on their unique circumstances. So of course the brain defaults to that information. Moreover, it has been proven that fatigue and overwork dramatically increase unconscious bias (source). Stress and energy level are also contributing factors. VCs can counteract the tendency to fall back on stereotypes by keeping up with self-care. For instance, they can make sure to get a good night’s sleep the evening before hearing a pitch or use mindfulness techniques to make sure they go into the meeting feeling calm and collected. They can also give themselves time to think over their decisions, so they’re not coming out of a long, tiring meeting and immediately deciding 'yes' or 'no'.

3) Structured decision-making: VC firms can implement structured decision-making processes (for example, by having a set scorecard). This can help to ensure that decisions are based on objective criteria, rather than subjective factors that may be influenced by unconscious biases. Moreover, it will help you to avoid making assumptions or relying on gut instinct.

4) Be careful about questions: A team of scientists observed a number of VCs and founders then tracked funding rounds of startups (source). Though all startups were comparable in quality and capital needs, the scientists found that male-led ventures raised five times more funding than the female-led startups. There was only one big difference between these teams. The researchers observed that male and female entrepreneurs were asked two distinctly different types of questions. VCs asked men 'promotion-oriented' questions about their 'hopes, achievements, advancement, and ideals,' while women were asked about 'prevention-oriented' questions that focused on 'safety, responsibility, security, and vigilance'. The bias was found with both male and female VCs. Advance preparation may be the best defense against this type of disparity. Before hearing a female entrepreneur pitch, a VC could sit down and write out several “promotion-oriented” questions and commit to asking them during the meeting. That way, they’ll be less likely to give into an instinct to ask only about potential losses and other 'prevention-oriented' topics. Optionally, VCs could come up with a standard list of questions to ask all entrepreneurs who pitch them, standardizing away question bias entirely.

5) Focus less on pedigree: Most investors are placing significantly more weight in characteristics that focus on pedigree versus grit, traction, or execution. Attending an elite academic institution or having previous work experience at a top tech company should not equate to increased points. Recent data has found that only about one third of founders of billion-dollar startups attended top-10 universities or worked at tier one companies like Google or McKinsey, so it’s time that we stop letting these metrics sway the scorecard.

6) Referral points: If a candidate comes from a referral (a direct introduction from someone within your network) it’s worth taking a look internally at the makeup of lead sources. For example, are your leads coming from university alumni networks, other investors, or colleagues from top companies you held previous positions with? Removing the referral component from the scorecard will help to eliminate bias and level out the playing field.

7) Control for likeability: It’s natural to feel drawn towards some people and not towards others. However, relying too much on this kind of natural chemistry when making funding or hiring decisions can open the door to bias. That means that startup founders who are culturally dissimilar from the average VC may suffer when decisions are based too much on likeability. That’s not to say likeability is always rooted in bias, or that it shouldn’t be taken into account in funding or hiring decisions at all. However, it’s important to remain aware of its impact on decision-making. When evaluating a pitch, I recommend you to rate founders on likeability like you would rate a technical skill or communication skills. Making likeability an explicit, measured metric makes it more 'controllable', so that it doesn’t get excessive weight.

8) Increase accountability for decision making: People are at their most biased when they are least accountable—that is, when they believe their decisions won’t be made public or that they won’t be asked to justify their reasoning. Whilst even small interventions, as simple as having another person in the room when a decision is made, can change outcomes for the better. Other strategies to reduce bias by increasing accountability include I) making the results of the decision identifiable, so the decision-maker knows they will be linked to him or her personally, II) requiring the decision-maker to give an explanation of their thought process after a decision is made, and III) asking to record an interview.

9) Increase diversity (in your team and in your network): One of the most effective ways to mitigate unconscious biases is of course to increase the diversity of the team making investment decisions. By bringing in people with different backgrounds and perspectives, VC firms can help to ensure that a broader range of viewpoints is represented. But also, change small behaviors: don't sit with the same colleague every day. Move around and spend time with people from different cultural and academic backgrounds. This will build your cultural competence and lead to better understanding. Go to events that widen your social circle.

10) Set diversity goals and make them public: Step 1: Set ambitious yet realistic goals about the desired diversity KPIs within your team, portfolio, your investor, and your advisor base. Step 2: Make these goals measurable, and measure the progress regularly. Step 3: Make them public. Be explicit about your intentions. Step 4: Make someone accountable. Step 5: Celebrate success.

11) Foster a culture of inclusivity: Speak out if you notice bias. For example, if a male colleague talks over a female colleague, tactfully point out that you wanted to hear what she had to say. Or avoid addressing the team as ‘Guys’, and apologize if you get it wrong. Remember that we can only deal with bias if we're honest and admit our mistakes. Moreover, VC firms can foster a culture of inclusivity by actively promoting diversity and inclusion in their hiring and investment practices. This can help to create a more welcoming and supportive environment for founders from underrepresented backgrounds, which can help to attract a more diverse range of investment opportunities.

Conclusion

Overall, tackling unconscious biases requires a concerted effort on the part of VC firms to promote awareness, foster diversity and inclusivity, and implement structured decision-making processes. By taking these steps, VC firms can help to ensure that their investment decisions are not unduly influenced by unconscious biases.

Now the good thing is we don't have to drastically change our way of thinking or behaving, we don't have to be super careful about what we say or think, nor do we have to do extensive soul-searching about where our unconscious biases come from (though that may be useful work to do for other reasons). Research shows that some simple interventions can greatly reduce the impact of unconscious bias on any decision-making process (source).

Don’t be too hard on yourself (and others). Take small steps—commit to one action to start with.

When people want to act more responsibly, they want to go ‘all in’. As otherwise they find themselves hypocritical. But every step counts, and every step is one to celebrate. So no need to do everything ‘perfect’, but already being conscious of trying to do the right thing most of the time and acknowledging that there is still work to do, is what counts.

Resources to read more about unconscious biases:

If you are interested to learn more about this topic, I can highly recommend watching the Unconscious Bias training from Google Ventures. If you would like to put yourself or your team to the test, check out the implicit bias test from Harvard Business School and find out what attitudes and beliefs you may be unaware of. Lastly, the books Thinking Fast and Slow and The Power of Habit are great reads to learn more about how our brain works and how biases are formed.